Treasury actions: understanding the Government’s selling process:

- Anatoly Iofe

- Nov 28, 2023

- 3 min read

Treasury auctions are a fundamental element in the complex realm of financial instruments. These auctions, often shrouded in complex financial terminology, are crucial for the U.S. government's operations and its fiscal strategies. Here we aim to simplify and highlight the significance of treasury auctions within the financial world.

Understanding Treasury Auctions

Essentially, a treasury auction is how the U.S. government borrows money. When its expenditures exceed its income from taxes and other sources, the government raises funds by issuing treasury securities, including bills, notes, and bonds, each varying in maturity and interest rates. These securities are sold to the highest bidder in treasury auctions.

How Treasury Auctions Operate

The process begins with the U.S. Department of the Treasury announcing the auction's details. Prospective buyers, ranging from individual investors to large financial institutions, submit bids specifying the amount they wish to purchase and their price offer. Treasury auctions feature two types of bids:

Competitive Bids

Here, bidders specify the yield they accept for a security. The Treasury prioritizes the bids with the lowest yields to minimize borrowing costs.

Non-competitive Bids

Bidders agree to accept the yield determined at the auction, ensuring they receive the security but at an unknown yield.

The bids are ranked by yield, and the Treasury accepts them starting with the lowest yield until the entire amount is sold. The highest accepted yield is known as the "stop-out yield," setting the security's interest rate.

The Importance of Treasury Auctions - Treasury auctions play a vital role beyond just debt issuance:

Interest Rate Benchmarking

The yields from these auctions set benchmarks for the broader interest rate environment, affecting rates on mortgages, car loans, and other credits.

Monetary Policy

The Federal Reserve uses these auctions to implement monetary policy, influencing the economy by buying or selling treasury securities.

Insights into Foreign Relations

The demand for U.S. treasury securities reflects international perspectives on the U.S. economy's health and stability.

Market Benchmark

U.S. Treasury securities, being virtually risk-free, serve as a standard for riskier market securities.

Recent Trends in Treasury Auctions

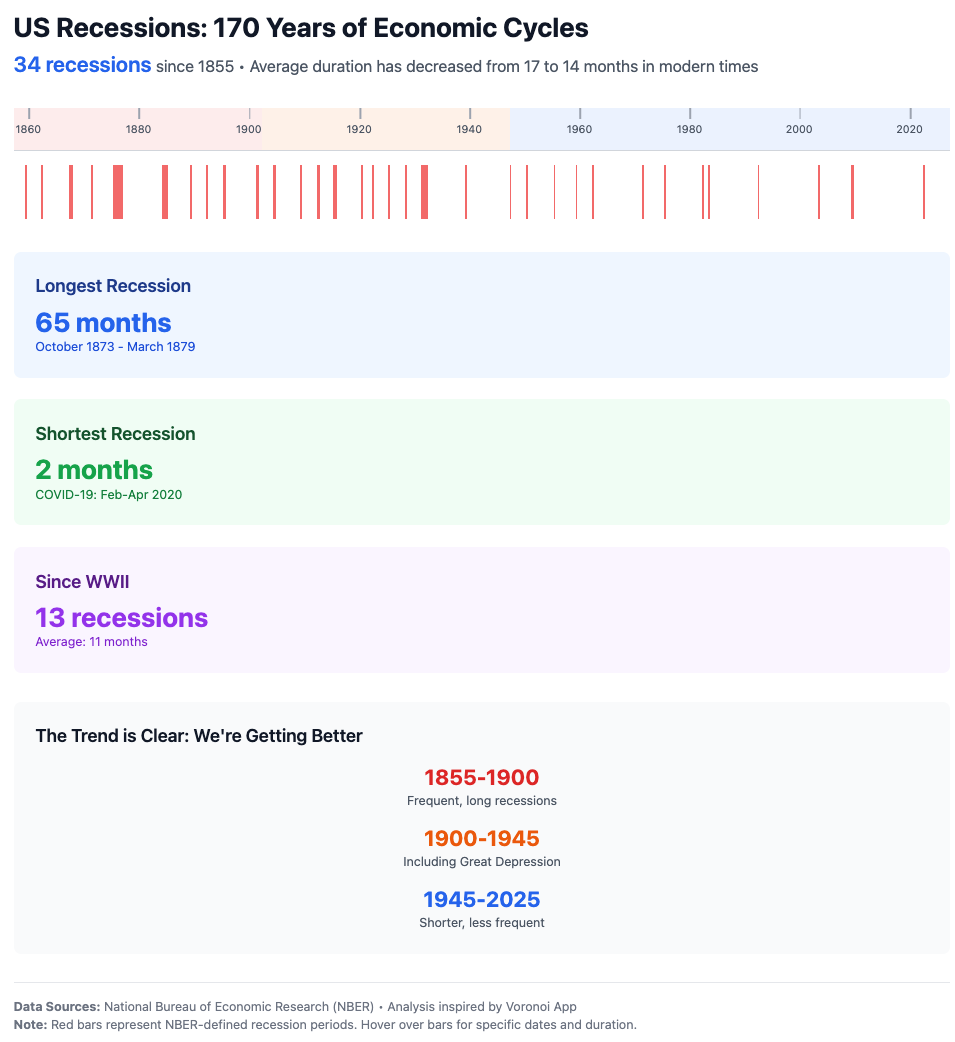

Lately, there's been an upsurge in the size of treasury auctions, indicating the government's growing borrowing needs, partly due to circumstances like the COVID-19 pandemic. Additionally, global uncertainties often lead to a "flight to quality," where investors seek the safety of U.S. Treasury securities, impacting yields in these auctions.

Challenges and Innovations - Treasury auctions face numerous challenges and are evolving with the times:

Rising Debt Levels

The increasing national debt necessitates more frequent and larger auctions, raising concerns about long-term fiscal health.

Technological Advancements

Digital innovations are streamlining the auction process, enhancing accessibility, competition, and transparency.

Global Economic Shifts

The growing involvement of emerging economies adds complexity to auction dynamics.

ESG Considerations

Sustainable investing trends are influencing demand, as investors increasingly prefer bonds funding environmentally and socially positive projects.

In summary, treasury auctions, though complex, are critical to the U.S. financial system. They not only provide necessary funds for government operations but also offer insights into the broader economic and geopolitical context. As the government's borrowing needs change, the significance and dynamics of treasury auctions will continue to evolve. Investors, policymakers, and the public should pay close attention to these significant events.

Have questions, schedule your no-obligation consultation here.

Sources:

Disclaimer:

Information provided is for informational purposes only, and does not constitute an offer or solicitation to sell, a solicitation of an offer to buy, any security or any other product or service. Accordingly, this document does not constitute investment advice or counsel or solicitation for investment in any security. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.